In today’s rapidly evolving business landscape, effective financial controls are critical for any organisation, whether a budding startup, a rapidly scaling SME, or a mature listed company. Strong financial foundations can safeguard an organisation against unexpected financial pitfalls, ensuring sustainable growth and accountability. This article explores the vital steps to establishing robust financial controls, the growing importance of these measures as businesses scale, and how Malander Advisory is positioned to support organisations at every stage of their growth journey.

Why Financial Controls Are Critical in Today’s Business Environment

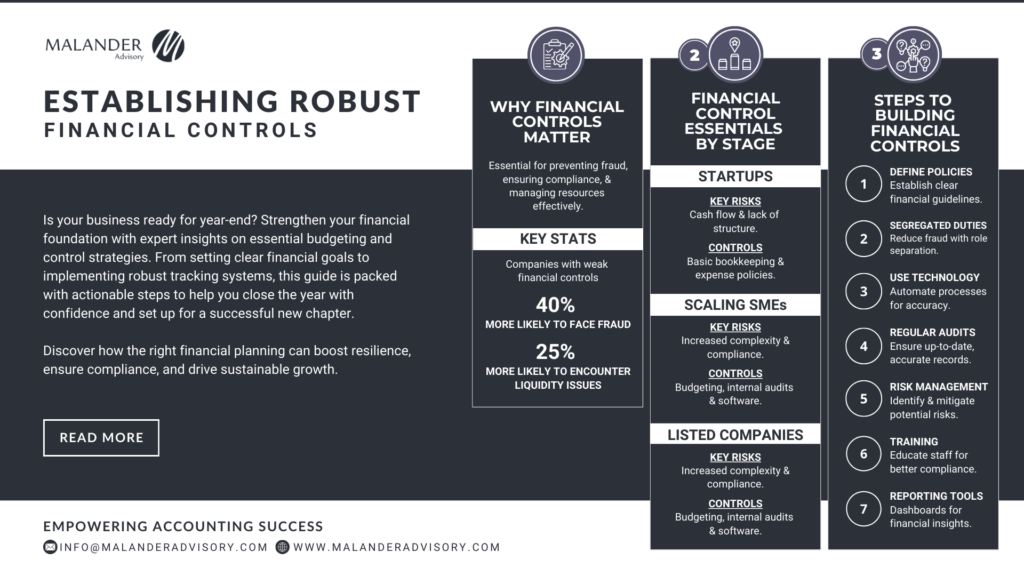

Financial controls are mechanisms and procedures implemented to manage a company’s financial resources, ensure accuracy in financial reporting, prevent fraud, and maintain operational efficiency. As businesses grow, the complexity of their financial operations increases, exposing them to a broader spectrum of risks, including compliance issues, operational inefficiencies, and the potential for financial misstatements.

The absence of robust financial controls can lead to severe consequences, including financial misstatements, increased vulnerability to fraud, inefficient use of resources, and damage to a company’s reputation. For listed companies, non-compliance with regulatory standards can lead to hefty fines and legal action, further emphasising the importance of implementing effective financial controls.

In a 2023 Deloitte report, it was highlighted that companies with poor financial controls were 40% more likely to experience internal fraud and 25% more likely to face liquidity issues, directly impacting long-term sustainability. This underscores the need for businesses of all sizes to establish a solid foundation early on and maintain those standards as they scale.

The Critical Stages: From Startup to Listed Company

- Startups:

- Key Risks: Cash flow management, lack of formal accounting procedures, and high dependence on a few key personnel.

- Need for Financial Controls: Startups often prioritise growth over financial control, which can be risky. Inaccurate cash flow predictions or unmonitored spending can lead to financial strain.

- Essential Controls: Establishing basic bookkeeping processes, segregating duties to avoid conflicts of interest, and implementing cash management policies to track expenses and revenues.

- Scaling to SME:

- Key Risks: Increased operational complexity, managing diverse revenue streams, and potential compliance requirements.

- Need for Financial Controls: As companies grow, more detailed reporting and forecasting become necessary to make informed decisions. Financial controls become critical in managing budgets, ensuring compliance, and preparing for audits.

- Essential Controls: Budgeting and variance analysis, internal auditing practices, and implementation of expense management, payroll, and invoicing software.

- Listed Businesses:

- Key Risks: Stricter compliance requirements, greater scrutiny from stakeholders, and higher expectations for transparent financial reporting.

- Need for Financial Controls: Listed companies face stringent regulations like the Sarbanes-Oxley Act (SOX) in the US or the UK Corporate Governance Code, requiring sophisticated financial controls to ensure accountability.

- Essential Controls: Comprehensive internal audit functions, detailed risk assessment and management, enterprise-level resource planning (ERP) systems, and implementing a dedicated finance department for oversight.

Key Steps to Establishing Robust Financial Controls

- Define Financial Policies and Procedures:

A robust financial framework starts with clear policies and procedures, covering purchasing, expense management, cash handling, and financial reporting. Documentation is essential to maintain consistency and clarity in operations. Malander can assist in drafting these policies, leveraging their expertise to create tailored guidelines that fit a company’s unique needs. - Implement Segregation of Duties:

Segregation of duties reduces the risk of errors or fraud by dividing financial tasks among different individuals or departments. This internal check mechanism is crucial for accountability and transparency. Malander’s finance resourcing solutions can provide temporary or long-term professionals who ensure proper segregation of duties and internal oversight, even in lean finance teams. - Leverage Technology for Automation:

Utilizing financial software and automation tools helps streamline processes and reduce human errors. Automated systems enable real-time tracking, data analysis, and accurate reporting. Malander supports companies in selecting and integrating financial software tailored to their needs, optimising workflows for better efficiency and oversight. - Conduct Regular Audits and Reconciliations:

Audits validate the accuracy of financial records. Regular reconciliations ensure that accounts, assets, and inventories are up-to-date and compliant with standards. Malander’s outsourcing services can handle regular reconciliations, internal audits, and compliance checks, allowing businesses to focus on their core activities while maintaining financial accuracy. - Establish a Strong Risk Management Framework:

Risk management involves identifying potential financial risks and developing strategies to mitigate them, ensuring long-term stability. Malander helps companies build risk management frameworks and implement mitigation strategies, from financial risk assessments to compliance audits. - Train and Educate Staff:

A knowledgeable team is essential for robust financial control. Training ensures that staff can recognise red flags and follow procedures. - Utilise Dashboards and Reporting Tools:

Dashboards provide a quick overview of financial health, enabling CFOs and finance teams to make data-driven decisions. Malander can implement and customise reporting tools, ensuring that businesses have access to clear financial insights that support informed decision-making.

Conclusion

Malander Advisory assists startups by setting up initial financial processes and frameworks. With services in finance resourcing, they provide the right talent, whether it’s a junior accountant or a fractional CFO, to guide startups through the early stages of financial discipline.

For SME’s Malander Advisory offers tailored finance function outsourcing, allowing businesses to focus on their growth while Malander handles accounting processes, internal controls, and financial reporting. Malander’s experts ensure that robust systems are in place to handle the complexities of scaling.

Malander’s accounting advisory services assist listed companies by guiding them through regulatory frameworks, providing expertise in ERP system implementations, and offering ongoing technical accounting support to ensure compliance and transparency.

In today’s business world, robust financial controls are not optional—they are essential. As businesses grow, the need for well-defined, scalable, and effective financial frameworks becomes increasingly crucial. Malander Advisory, with its deep industry knowledge and specialized services, is ideally positioned to help businesses establish and maintain the financial controls necessary to thrive in a competitive environment.